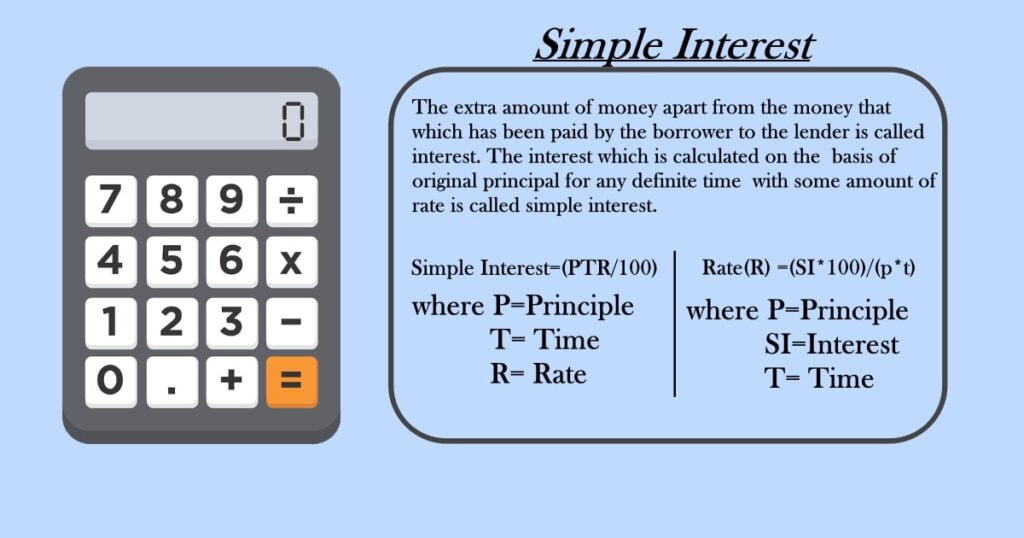

To calculate the interest expense, multiply the principal borrowed by the interest rate and the time period. Interest expense calculation with journal entries

#Interest expense formula full

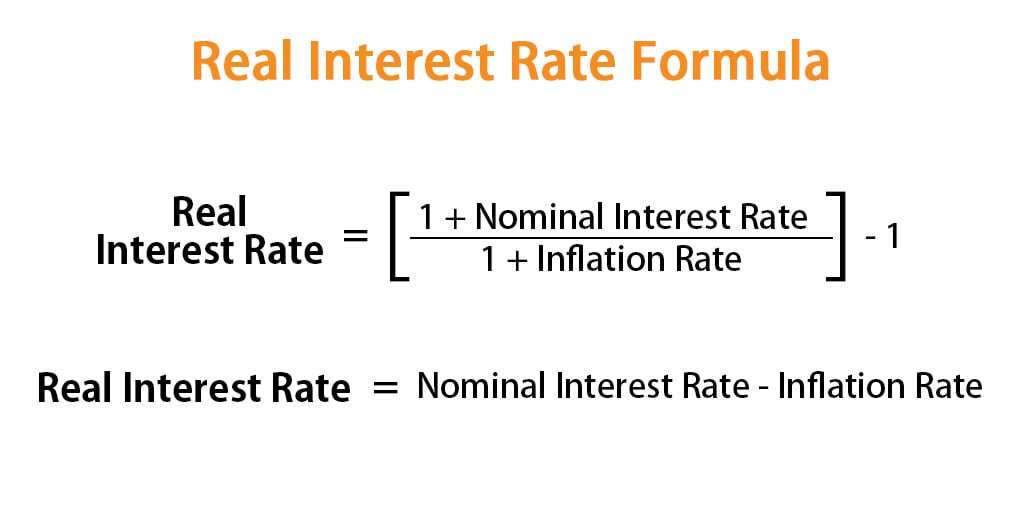

We’ll also assume the company pays interest on the total principal balance evenly over the life of the loan (calculated as simple interest rather than compound interest) and pays the full principal amount of the loan back as a lump sum at the end of the year. To illustrate interest accrual with the example from above, let’s assume the company entered into the loan for the equipment with an annual interest rate of 6% and agrees to make four quarterly interest payments. When periodic principal and interest payments are made to the borrower, the amount of accrued interest being paid is relieved from the accrued interest account. If the borrower is an accrual-based company, they match expenses to the period incurred and will aggregate, or accrue, interest over the time the funds are borrowed in an accrued liability account on the balance sheet. If the borrower is a cash-based company, they record the interest expense as it is paid. The difference between the principal amount borrowed and the total amount repaid is interest.įrom an accounting perspective, the borrower records interest as an expense on the income statement. The total amount paid to the bank will ultimately be more than the $100,000 initially borrowed. The fee is the bank’s consideration for assuming the risk of the possibility the company may not be able to pay the amount borrowed back or for allowing the company to use the funds. The bank charges a fee on the principal amount borrowed, which is paid by the borrower over the time it takes to pay back the borrowed amount. They will then pay back the borrowed amount to the bank periodically over a set amount of time – let’s assume it’s one year. The company can immediately use the borrowed $100,000 to purchase the equipment from the seller.

Instead, the company borrows the $100,000 from a bank. From the perspective of the lender, interest is the income collected from allowing a third party use of money over a period of time.įor example, a company wants to buy a $100,000 piece of equipment and chooses not to pay the total amount up front. From the perspective of the borrower, interest is the fee paid for the use of borrowed money or an asset which is not yet owned. Interest is the additional consideration paid in excess of the value of what is borrowed, usually expressed as an annual rate.

Solo Agers: Plan NOW If You Want To Thrive In LaterLife.Ask Larry: What Have I Done To Myself By Filing For MySocial Security Benefits Early?.The Top Money Moves To Make for Each Generation.The value of hepatitis C (HCV) screenings for adults.What is a living benefits life insurance rider?.When Spending More Doesn’t Get You More.Skills gap causing over half of businesses to feel severepressure.‘There is a huge opportunity here for music publishingA&R.’.Impact of the Lease Accounting Transition and COVID-19 onBalance Sheet Liabilities.Avoiding a fall-out from the super guaranteeincrease.

The Insurance Guide for New Homeowners for 2021.5 More Plead Guilty in New Orleans Staged Truck Accident Cases.6 tips to secure your home computer network.Allstate Publishes 19th Sustainability Report.Moving beyond 2020: How insurers supported their communities and customers.Credit-Based Insurance Scores – The Battle Heats Up.

0 kommentar(er)

0 kommentar(er)